Some Known Details About Clark Wealth Partners

Clark Wealth Partners for Beginners

Table of ContentsOur Clark Wealth Partners PDFsMore About Clark Wealth PartnersGetting The Clark Wealth Partners To WorkGet This Report about Clark Wealth PartnersClark Wealth Partners for Beginners

Their duty is to assist you make notified decisions, avoid pricey mistakes, and remain on track to fulfill your long-lasting goals. Handling finances can be challenging, and feelings usually shadow judgment when it concerns money. Fear and greed, for example, can result in spontaneous decisions, like panic-selling during a market recession or chasing options that do not straighten with your risk resistance.

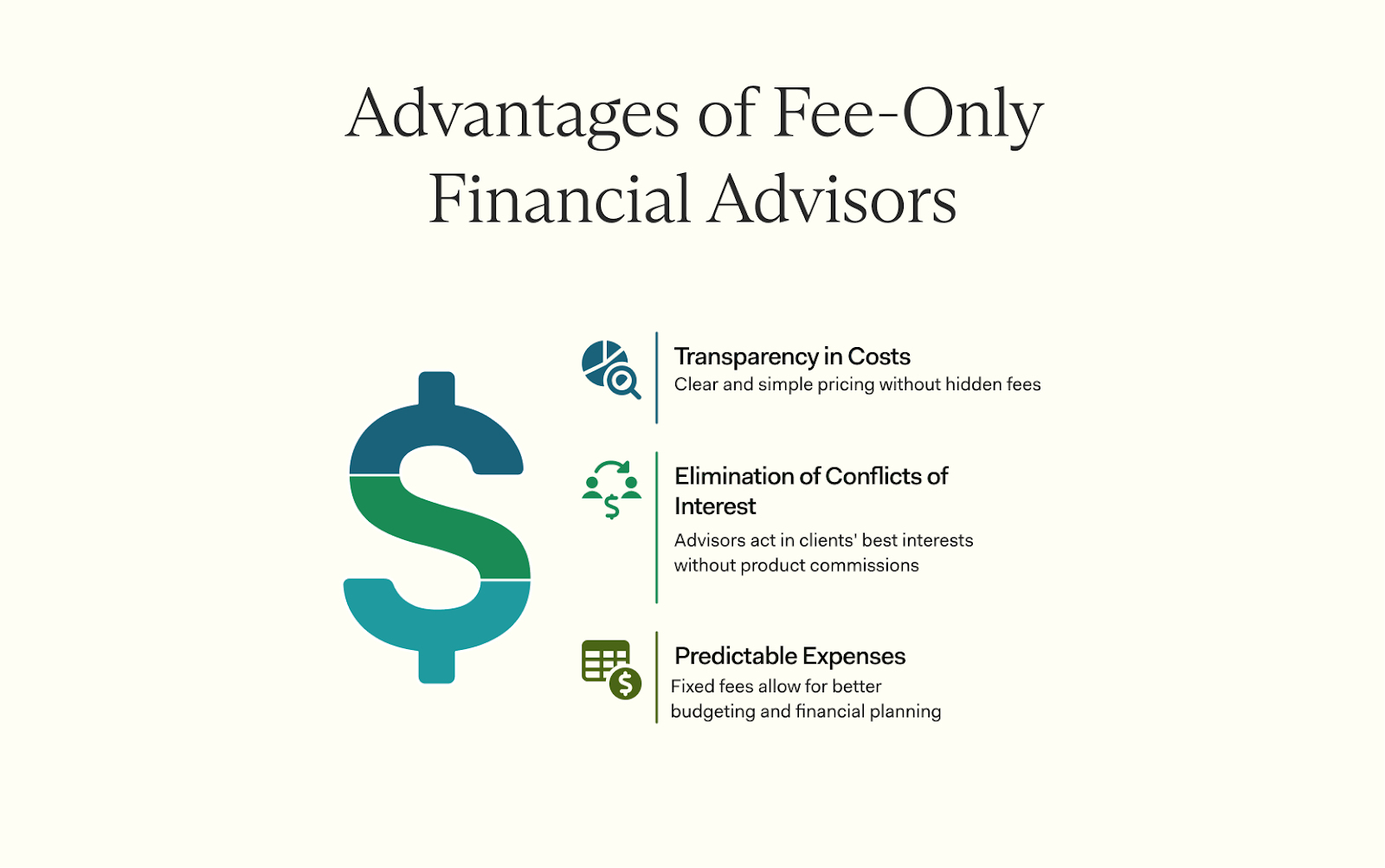

It's vital to understand their fee structure and ensure it fits your monetary scenario. For numerous people, the experience, neutrality, and comfort that a consultant offers can be valuable, yet it is necessary to consider the connected prices. Equally as professional athletes, trainers, and coaches help individuals attain their ideal in various other areas of life, a monetary expert can play a crucial function in assisting you construct and protect your monetary future.

Investors should make financial investment choices based upon their unique financial investment objectives and financial circumstance (https://blackgreendirectory.com/gosearch.php?q=https%3A%2F%2Fwww.clarkwealthpartners.com%2F&search-btn.x=17&search-btn.y=5). ID: 00160363

Excitement About Clark Wealth Partners

It's regarding aiding customers to navigate adjustments in the environment and recognize the impact of those modifications on a continuous basis," says Liston. An advisor can additionally help clients manage their properties more efficiently, says Ryan Nobbs, an economic advisor for M&G Wide range Advice. "Whereas a customer may have been saving formerly, they're now mosting likely to begin to draw a revenue from various possessions, so it has to do with placing them in the right products whether it's a pension, an ISA, a bond and after that drawing the income at the appropriate time and, critically, keeping it within certain allocations," he claims

"Then you enter into the world of income tax return, estate preparation, gifting and wills. It's quite hard to do all of that on your own, which is why a professional can help customers to reduce via the complexity." Retirement planning is not a one-off event, either. With the popularity of income drawdown, "investment doesn't stop at retirement, so you need an element of know-how to understand just how to get the appropriate mix and the right equilibrium in your financial investment services," says Liston - http://www.askmap.net/location/7615714/united-states/clark-wealth-partners.

The smart Trick of Clark Wealth Partners That Nobody is Discussing

As an example, Nobbs had the ability to assist among his clients move money right into a variety of tax-efficient products to make sure that she might draw an income and would not have to pay any kind of tax obligation till she was about 88. "They live conveniently now and her husband had the ability to take very early retired life therefore," he says.

"People can come to be truly worried regarding just how they will certainly money their retired life since they don't recognize what placement they'll be in, so it pays to have a conversation with a monetary adviser," claims Nobbs. While conserving is one noticeable advantage, the worth of advice runs deeper. "It's all about offering people comfort, recognizing their needs and aiding them live the lifestyle and the retirement they desire and to look after their family if anything need to occur," claims Liston.

Seeking financial recommendations could seem frustrating. In the UK, that is fuelling an expanding recommendations void just 11% of grownups surveyed stated they would certainly paid for economic suggestions in the past 2 years, according to Lang Pet cat study.

This is known as a restricted guidance service. With modifications in tax obligation regulation and pension policy, and hopefully a lengthy retired life in advance, people coming close to the end of their jobs need to navigate a progressively challenging backdrop to guarantee their economic needs will be satisfied when they retire.

Some Known Facts About Clark Wealth Partners.

"If you get it incorrect, you can wind up in a collection of challenging circumstances where you may not be able to do the things you intend to perform in retirement," says Ross Liston, Chief Executive Officer of M&G Wealth Suggestions. Looking for monetary guidance is a good idea, as it can help individuals to take pleasure in a stress-free retirement.

While there's a riches of financial planning info offered, it's significantly hard to move on with a determined method that does not panic or stay asleep at the wheel. A monetary plan customized to your details situation develops significant worth and assurance. And while it may be appealing to self-manage or use a robo-advisor to conserve on professional charges, this method can prove expensive in the future.

Here are the top five reasons employing a specialist for economic recommendations is useful. While it may be appealing to self-manage or utilize a robo-advisor to save on professional charges, this technique can show costly in the future. An economic advisor who supplies an independent and objective viewpoint is essential.

Not known Incorrect Statements About Clark Wealth Partners

By comparison, investors who are working tend to value retired life and tax obligation preparation guidance best. These findings may present some generational effect, because financial guidance traditionally has been even more focused on financial investments than economic preparation (retirement planning scott afb il). The complexity of one's situations additionally may have an influence on the understanding of worth

All told, people that pay for advice ranked much more advice elements as extremely valuable than those who did not. This result can recommend that searching for value in more aspects causes people to spend for suggestions. The reverse can be real in some instances: Paying for an advisor might reinforce the idea that the benefits are valuable.

Since the economic climate changes and develops every day, having a sane close friend by your side can be a definitive factor for successful investment choices. Every person has his/her own economic situation and challenges to manage (https://www.giantbomb.com/profile/clarkwealthpt/). An economic coordinator thoroughly checks your present assets and responsibilities, and future purposes to establish an individualised individual economic plan